how are 457 withdrawals taxed

For this calculation we assume that all contributions to the retirement account. Applicable dollar limit plus sum of unused deferrals in prior years only if deferrals made were less than the applicable deferral limits Note.

:max_bytes(150000):strip_icc()/taxes-in-retirement-how-much-will-you-pay-2388083v-6-5b4cba9fc9e77c0037315bd8-8ed4f6b983744e1ba2e910636aa65873.png)

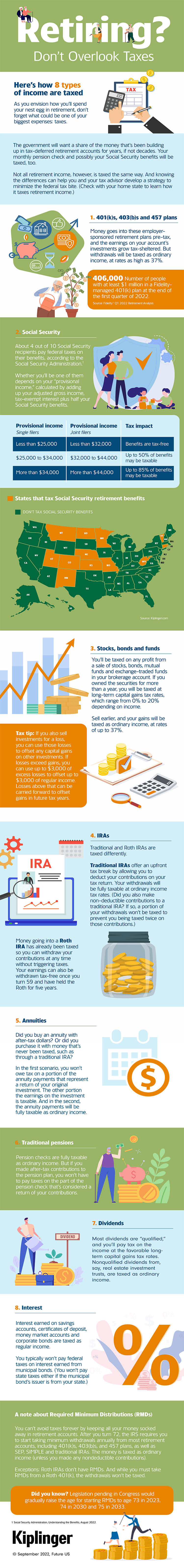

Estimating Taxes In Retirement

Unlike other tax-deferred retirement plans such as IRAs or.

. How much tax do you pay on a 457 b withdrawal. US federal tax law requires that most distributions received under state 457b plans that do not transfer directly to an IRA or other. How much can I withdraw from my 457 plan.

Once you leave your job you can make an early withdrawal from your 457b plan and you wont be subject to the 10 penalty tax that other employer-sponsored plans have. Any attempted rollovers to an IRA of amounts distributed from a 457f plan or a 457b plan maintained by a tax-exempt entity are excess contributions that are subject to IRC. At 50 that limit.

The amount you wish to withdraw from your qualified retirement plan. Withdrawals are subject to income tax. If you have a 457b you can withdraw the budget from your account without any early withdrawal penalty.

For this calculation we assume that all contributions to the retirement account. However distributions from a ROTH 457 plan are not subject to tax withholding. Withdrawals are subject to income tax.

Distributions to a participant from a tax-exempt employers 457b plan are wages under 3401a that are subject to income tax withholding in accordance with the income tax. Withdrawals from 457 retirement plans are taxed as ordinary income. However if you save on the 403b you will receive a 10 penalty.

The amount you wish to withdraw from your qualified retirement plan. You may also incur an additional 10 penalty. These vary from one year to the next but for 2019 youre limited to 19000 if youre under the age of 50.

For this calculation we assume that all contributions to the retirement account. Plans of deferred compensation described in IRC section 457 are available for certain state and local governments and non-governmental entities tax exempt under IRC Section 501. Any investment earnings you withdraw early will be added to your income for the year and taxed at your ordinary-income tax rate.

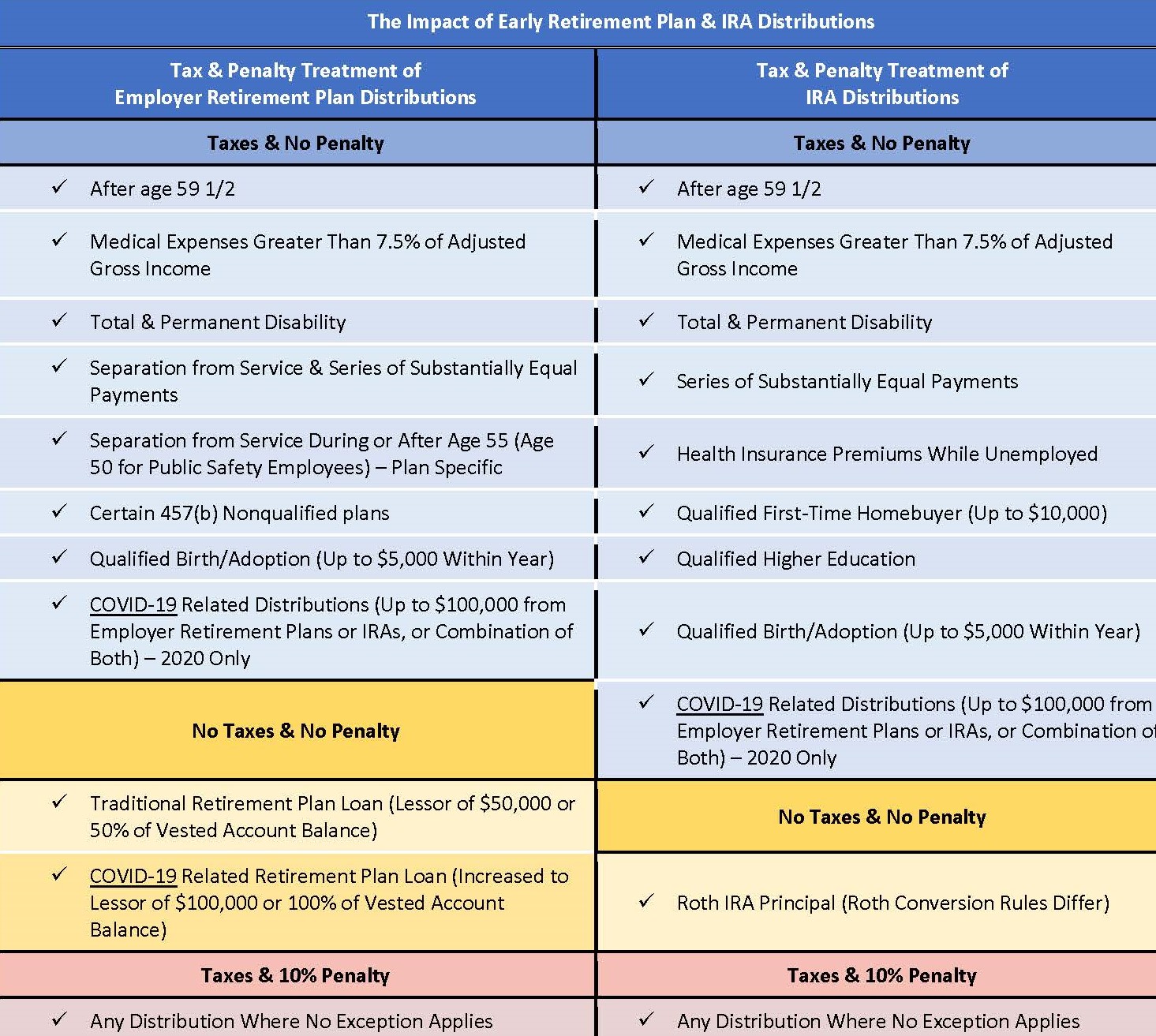

Early withdrawals from a 457b are subject to the 10 penalty if the accountholder rolls the funds over from a 457 to any other tax-advantaged retirement. All distributions from IRAs 401ks 403bs and 457 accounts are subject to income taxes at ordinary income tax rates except Roth accounts. Withdrawals are subject to income tax.

Age 50 catch up contributions not. When you retire or leave your job for any reason youre permitted to make withdrawals from your 457 plan. The amount you wish to withdraw from your qualified retirement plan.

457 Plan Withdrawal Calculator

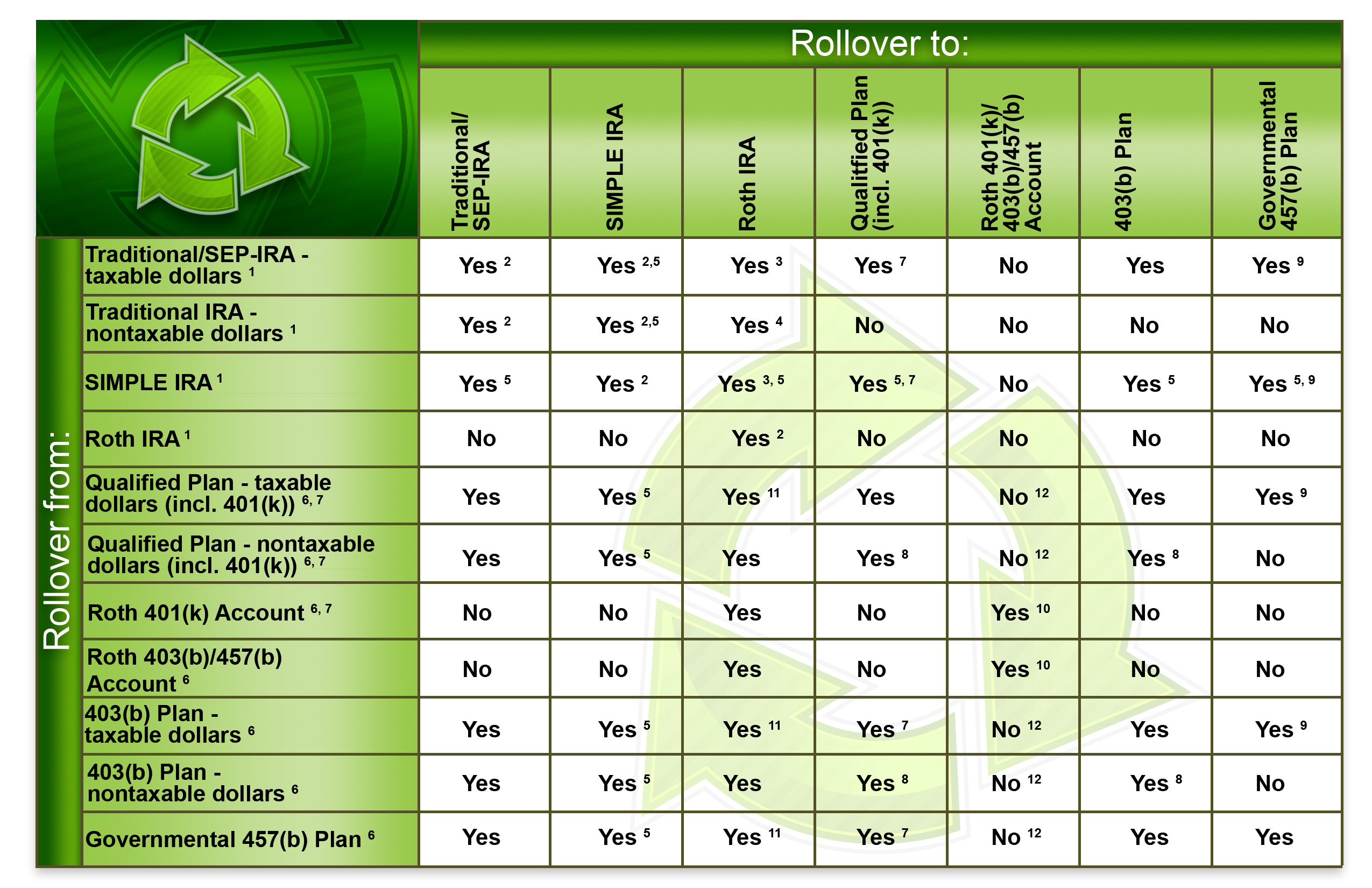

Retirement Account Rollovers West Michigan Financial Services

457 B Island Savings Plan Pre Tax Office Of Human Resources

Tax Deferred Vs Tax Free Investment Accounts David Waldrop Cfp

Sec 457 F Plans Get Helpful Guidance Journal Of Accountancy

The Taxman Leaveth 2021 A No Tax Early Retirement Physician On Fire

Navigating The Number Jumble A 403 B 401 K And 457 B Comparison

457 Deferred Compensation Plan White Coat Investor

How Can I Get My 401 K Money Without Paying Taxes

Using A 457b Plan Advantages Disadvantages

:max_bytes(150000):strip_icc()/required-minimum-distributions-2388780-468edc9cab63492cb046bc28d72fd5c1.jpg)

All About Required Minimum Distribution Rules Rmds

Accessing Retirement Funds Early During Covid 19 Triage Cancer Finances Work Insurance

The Tax Cuts Jobs Act Makes Roth Ira Conversions More Favorable Burton Enright Welch

Is The Tsp A 457 Plan Government Worker Fi

457 Plan Meaning Retirement Plan Benefits Limits Vs 401k

Comments

Post a Comment